January is a time for summaries and we too, in today’s article, want to summarise the past year, mainly in terms of the situation on the IT market in Poland. What can be said without even looking at the statistics is that, like 2023, 2024 was not an easy year. Although it was characterised by fewer redundancies and job cuts, the uncertainty experienced by both employees and employers in the sector hit hard and slowed down the development of the industry.

In the following article, we will review the situation of the IT labour market in 2024, discuss the reasons for this, and try to provide trends for 2025.

Is the industry crisis really a surprise?

In order to properly understand what happened to the IT labour market in Poland last year, we certainly need a broader context. For it is impossible to analyse 2024 in isolation from the events of four years ago related to the global coronavirus pandemic. In 2020, the IT market, after a short period of uncertainty related to the outbreak of the pandemic, experienced the highest growths that other industries could only dream of. This was a natural consequence of moving our lives, both private and professional, to an online reality. There were remote learning tools, medical platforms for health tele-consultations, a multitude of instant messaging services used at work and even, to provide a bit of entertainment, online games for many participants, often used as a replacement for the old integration in companies.

It is obvious that to create all these platforms and tools, a lot of specialists were needed to develop new solutions and adapt them to our new reality. It is only natural, however, that after such a boom in tools for working and learning remotely, society, once the pandemic has subsided, will want, at least to some extent, to return to its ‘old’ reality, to everyday meetings at the office, university or school. As a result, the demand for and dynamic development of new tools has decreased significantly, and the world has begun to face other problems: armed conflicts, economic slowdown and high inflation. Not surprisingly, companies in various industries had to change their strategy from dynamic growth to maintaining business as usual and their core sectors. For the IT industry, this therefore meant far fewer new projects and a focus on maintaining existing systems. Consequently, as many IT specialists as during the pandemic were no longer needed, and this resulted in a very high number of redundancies in the sector.

However, this is not the only pain point for the IT market in 2024. There are more reasons for the difficult situation for employees and candidates in this industry, but I will only focus on a few of them.

Bench – The so-called ‘Bench of Reserves’, which, during the pandemic and growth of the industry of recent years, began to grow at an alarming rate. Companies, which were firing off a multitude of new projects every month, were inundated with orders and could not keep up with them, hiring people ‘on a reserve bench’ because they adhered to the principle that they could not afford NOT to hire employees, even if their competences were not used 100%. They were counting on an increasing number of projects because the market situation allowed such optimistic scenarios. Of course, such a strategy was perfectly justifiable during the IT services boom, but in 2024 there were simply too many employees on the ‘bench’ and new recruits were not even considered when it was difficult to secure projects for existing employees.

The (R)evolution of AI – The boom in AI tools and technologies, which further intensified in 2024, caused even IT professionals to become concerned about their employment and the future of the profession. Artificial intelligence was indeed on everyone’s lips, both big and small players in the industry, but contrary to expectations, it did not take away jobs from millions of people around the world, including software developers, but it was obviously not without its impact on the labour market situation. As far as the IT industry is concerned, the most noticeable change has been, and continues to be, the skill structure you need to have in order to continue working in the industry. It is no longer enough to be able to code, but rather to have soft skills that enable you to work effectively with clients. The most sought-after technologies among IT professionals have also changed, and now include Python, Machine Learning, PyTorch and the cloud. Cybersecurity and Data and BI specialists are also gaining strong interest from recruiters.

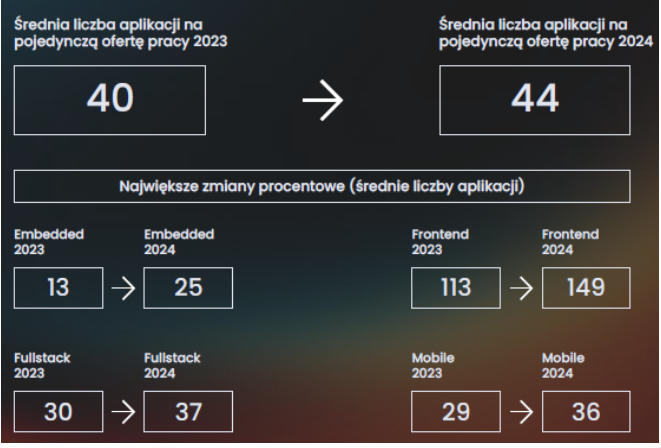

Overproduction of professionals – It is obvious that the interest in the industry, which has had the highest average median salaries for years (and even in 2024 this was the case), is huge. Just as until now, we have been used to a market for an employee, now, with the launch of many new courses relating to the IT sector at Polish universities and popular software bootcamps, there is an ‘overproduction of specialists’. The market has been flooded by people who have decided to re-invent themselves and try their hand in the mystical world of IT. Unfortunately, over the last two years, the situation has strongly changed and now the average number of CVs per ad in this industry, is 149, and for junior positions it can reach a value of up to 370 CVs per ad.

Summary statistics for 2024 in the IT industry

Now let’s look at the statistics that summarise the past year in the IT industry very clearly:

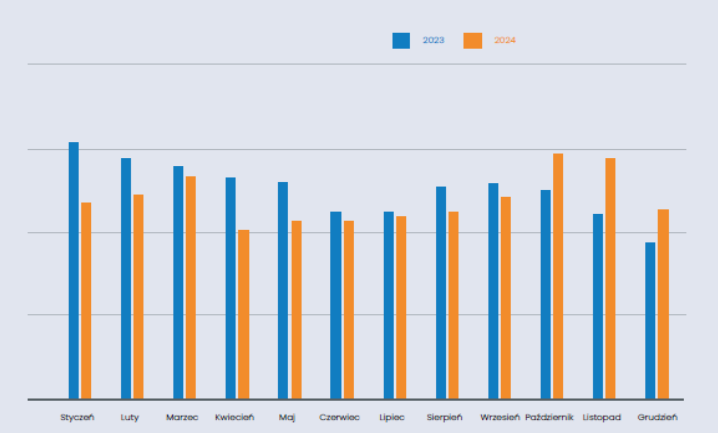

- there were more job offers in 2024 than in 2023, but the increase was small – at 2.6% month-on-month.

New offers on the IT job market – a month-on-month comparison of 2023 and 2024

Source: No Fluff Jobs report ‘IT labour market 2024/2025’

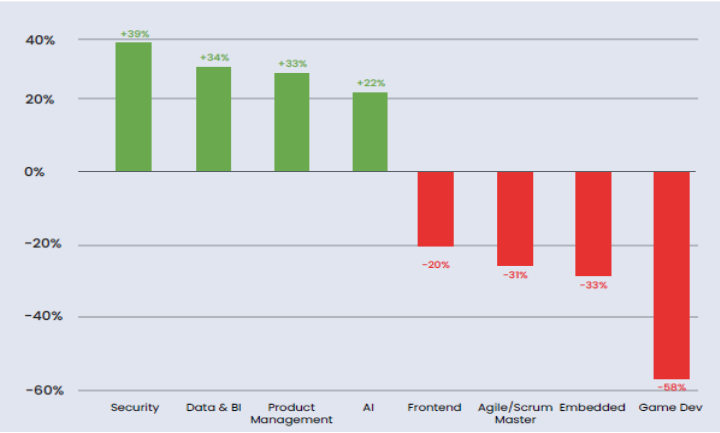

- It can be seen that there are specialisations in IT that are gaining significantly in interest. Categories such as AI, Data Intelligence and BI, Product Management and Data Analytics have scored serious increases in the number of advertisements. There are also some that have seen continued declines, with Gamedev (-58% year-on-year), and Embedded (-33% year-on-year) leading this category.

Categories with the largest increase/decrease in new job vacancies (2024 v 2023)

Source: No Fluff Jobs report ‘IT labour market 2024/2025’

- Earnings in the industry tended to stagnate, it was a year of stagnation in this respect, with rates even decreasing in some areas. An area that was able to enjoy increases was security, where median average earnings (for a B2B contract), increased by 11.4% over 2023. Specialisations that scored a salary adjustment were Frontend, Mobile and Project Management.

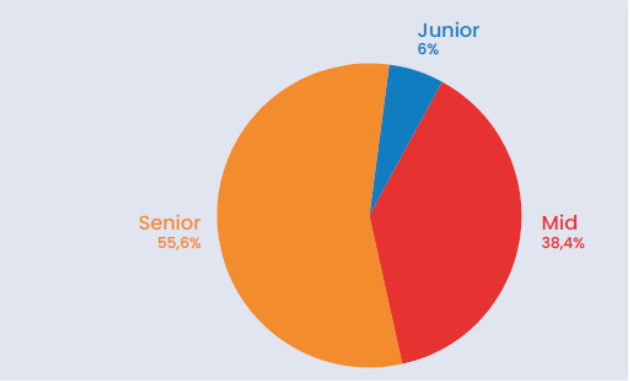

- Only 6% of all offers published on job portals in 2024 were those for Juniors (down 2% on 2023).

Level of experience required for job offers

Source: No Fluff Jobs report ‘IT labour market 2024/2025’

- There was a significant increase in the number of applicants per advert, obviously the increase varied, in different areas, but for junior positions, the number of applications sent, was up to three times higher.

Source: No Fluff Jobs report ‘IT labour market 2024/2025’

Will 2025 in the IT industry be a time of rebound?

The ideal scenario for 2025 would be a return to the status quo for the IT industry as we knew it at the start of the pandemic. Will this be the case? The chances of this are rather slim, the industry is rather seeking to stabilise in a safe place for it, and we must leave the initial gigantic increases rather in the realm of pleasant memories.

This does not mean that a rebound in the IT market will not happen. On the contrary, there are several factors that could herald it, make us optimistic for the future and the return of more work for juniors, new technology investments and projects flowing from clients.

What would have to happen in 2025 for this to be the case?

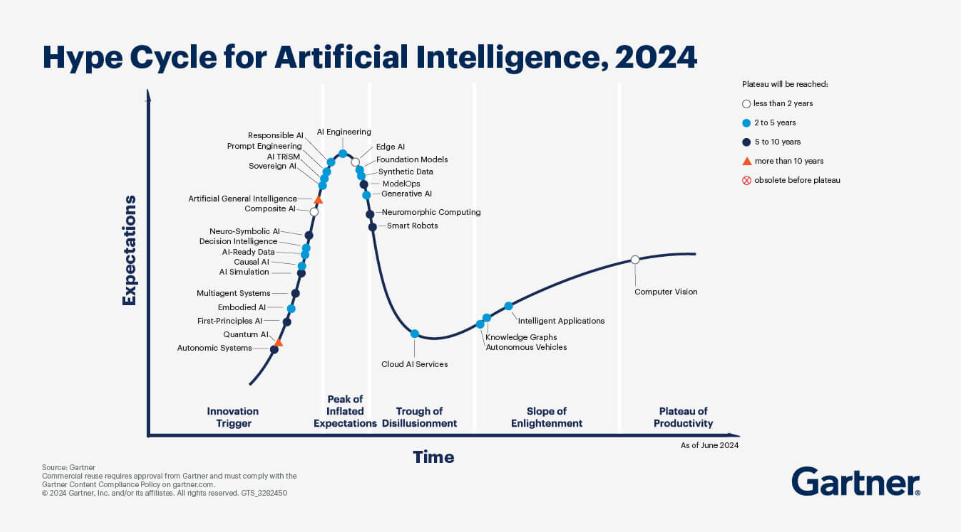

- Yearning with artificial intelligence – As in any area of life, certain ‘fads’ come and go. I am not saying that AI will go into oblivion in 2025, because it is an evolution that is more likely to stay with us. In all likelihood, however, it will slow down significantly. The sentiment towards AI-enabled tools is perfectly illustrated by the curve prepared by the Gartner Institute.

Although AI will continue to grow, interest in this area will decline. This may happen for a variety of reasons, but we already know that AI is failing in many areas, and is not developing fast enough to perform tedious but knowledge-intensive tasks. Yes, it is an auxiliary tool, but one that humans still need to check very carefully. In addition the costs of implementing AI tools are often so high that smaller companies in particular wonder why they should do this when they can hire specialists in this area more cheaply area (yes, I’m even talking about IT specialists ;)).

- Ending armed conflicts – The end of armed conflicts is, of course, not only the hope of the IT players, but above all, of the direct participants in these conflicts and their immediate neighbours. Wars consume huge budgets, the economy shifts to armaments and there is no room for starting innovative projects. Also external investors do not want to invest capital where it has such an uncertain future. An end to the war in Ukraine and Israel would significantly improve the global situation. From Poland’s perspective, this would also be a great scenario, as it is these two conflicts that are closest to us.

EU policy change – It is not a well-known fact that EU decisions strongly affect the economies of all member states. Over-regulation in many areas does help to stabilise, for example, the rapid development of AI or the reduction of the carbon footprint, but in terms of competitiveness and the cost of doing business in the EU, over-regulation makes it very difficult to attract new investors and to compete internationally with the biggest players in the technology race, such as the USA and China. A loosening of regulations or a change in EU policy towards more innovation would help companies operating in the intra-Community market to shift from constantly adapting their strategies to new guidelines and give more room for research and development.

Conclusion

In conclusion, 2025 has the potential to be a rebound year for the IT industry. Many factors point to the fact that we have already passed through the most severe phase of the correction and recession, and at least 2 of the 3 scenarios above are likely to come true and restore positive sentiment in the industry. Let’s keep our fingers crossed for that!